Unlocking the Potential: Maximizing ESG Value in Your Company

Evaluating the Benefits from the ESG Value

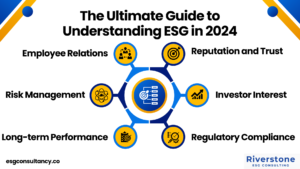

There are a number of benefits that can be gained from evaluating the ESG value chain:

- Improved Risk Management:- Evaluating the ESG value chain can help organizations identify and manage risks related to environmental, social, and governance issues.

- Enhanced Corporate Reputation:- Organizations that are seen as leaders in sustainable finance can gain a competitive edge over those that are not.

- Increased Access to Capital:- Organizations that demonstrate strong ESG performance may have an easier time accessing capital from investors who prioritize sustainable finance.

- Greater Efficiency and Effectiveness:- Evaluating the ESG value chain can help organizations improve their efficiency and effectiveness by identifying action and ways to reduce environmental and social impacts.

- Increased Access to International Capital:– The sustainable finance space is becoming increasingly international in nature.

How to Evaluate ESG Value

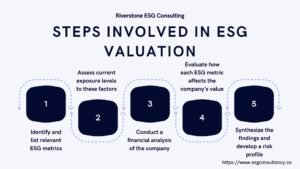

There is no one-size-fits-all approach to evaluating ESG value. However, there are a few key steps that can help organizations quantify and communicate their sustainable finance value:

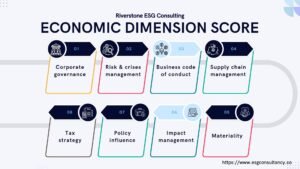

- Identify the Scope of Sustainable Finance:- Organizations should determine how they define sustainable finance and identify the specific environmental, social, and governance issues that they will consider.

- Quantify Environmental, Social, and Governance Impacts:- Organizations should quantify the environmental, social, and governance impact of their activities. This could involve using tools such as impact assessments or materiality assessments.

- Evaluate Management Systems:- Organizations should assess how well their management systems address environmental, social, and governance issues.

- Communicate Sustainable Finance Value:- Organizations should communicate their findings in a way that is easy for investors to understand. This could involve developing sustainability reports or ESG scorecards.

Why you should implement the ESG value in your company

- Shareholders prefer sustainable companies. A recent survey revealed that 87% of shareholders agree or strongly agree that a company’s environmental, social, and governance policies are important considerations when deciding where to invest their money.

- The Sustainable Development Goals call for action from the private sector

-

- The United Nations launched a set of Sustainable Development Goals in 2015 as part of an effort to target economic inequality and climate change by 2030.

- These goals place a huge focus on engagement from the private sector in order to achieve these objectives.

- Transparency is key for investors

-

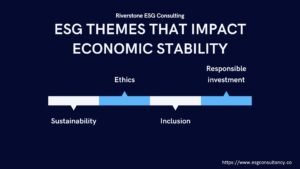

- Investors want transparency about how investments affect ESG issues such as;

- climate change

- risks and opportunities

- poverty alleviation, & inclusion,

- human rights

- deforestation

- Tax evasion.

- Competitiveness will suffer if organizations are not implementing sustainable finance. More than half (53%) of investors said they would cut back on investments in companies with no significant ESG policies or initiatives.

- There is a growing trend towards sustainable investing

-

- The amount of money invested by organizations committed to ESG-related causes has grown 65% since 2010, reaching $3 trillion globally in 2014.

- This trend is expected to accelerate as more sectors begin to implement sustainable finance practices, such as the food & beverage industry.

- Legislation is building momentum for responsible corporate behavior. In June 2015, the Obama administration unveiled several new policy proposals aimed at curbing climate change and reining in carbon dioxide emissions.

- There is a push towards zero deforestation. In May 2015, a coalition of more than 30 corporations including Unilever, Nestle, and Mattel announced that they will no longer purchase products that contribute to deforestation.

- The Principles for Responsible Investment are gaining momentum. In April 2014, an additional 309 investors representing $24 trillion in assets under management joined the PRI initiative, bringing the total number of signatories up to 715 representing $59 trillion in assets under management as of June 2015.

- It’s what millennials want. A recent survey by Ernst & Young found that 79% of millennial investors around the world believe it is important for companies to have a positive impact on society and 71% want to work for a company that makes a positive contribution to society.

- It’s good for your brand

-

- In 2012, Cone Communications released results from an annual corporate reputation survey which showed that “green” was the number one reputation characteristic among consumers,

- Beating out factors such as product quality and social responsibility – something that can be directly attributed to sustainable finance practices.

- Businesses are coming together. In 2010, the UN Principles for Responsible Investment (UNPRI) initiative saw signatories representing $45 trillion in assets under management promise to engage with portfolio companies’ management teams on environmental, social, and governance (ESG) issues.

- Sustainability is becoming a competitive advantage. In a 2014 survey of 1,000 investors by the asset management firm Schroders, 78% of respondents said they saw sustainability as a potential source of competitive advantage for their investments.

- You can make a difference. Through sustainable finance practices, businesses can help to achieve the United Nations’ Sustainable Development Goals which call for action in areas such as climate change, economic inequality, and human rights.