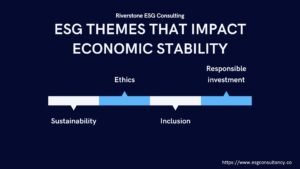

Trends Shaping the ESG Landscape in 2024

ESG landscape

The following are six trends that will drive the ESG landscape:

- Expanded coverage:- The first trend is expanding coverage of companies and industries covered by ESG indexes and research, as opposed to only covering clean technology, energy, and social issues.

- Expanding methodology:- The second trend is expanding the number of metrics used in ESG analyses including non-financial factors such as sustainability policies and practices as well as assessing management quality.

- Increased investment:- The third trend includes an increase in private investors into sustainable funds.

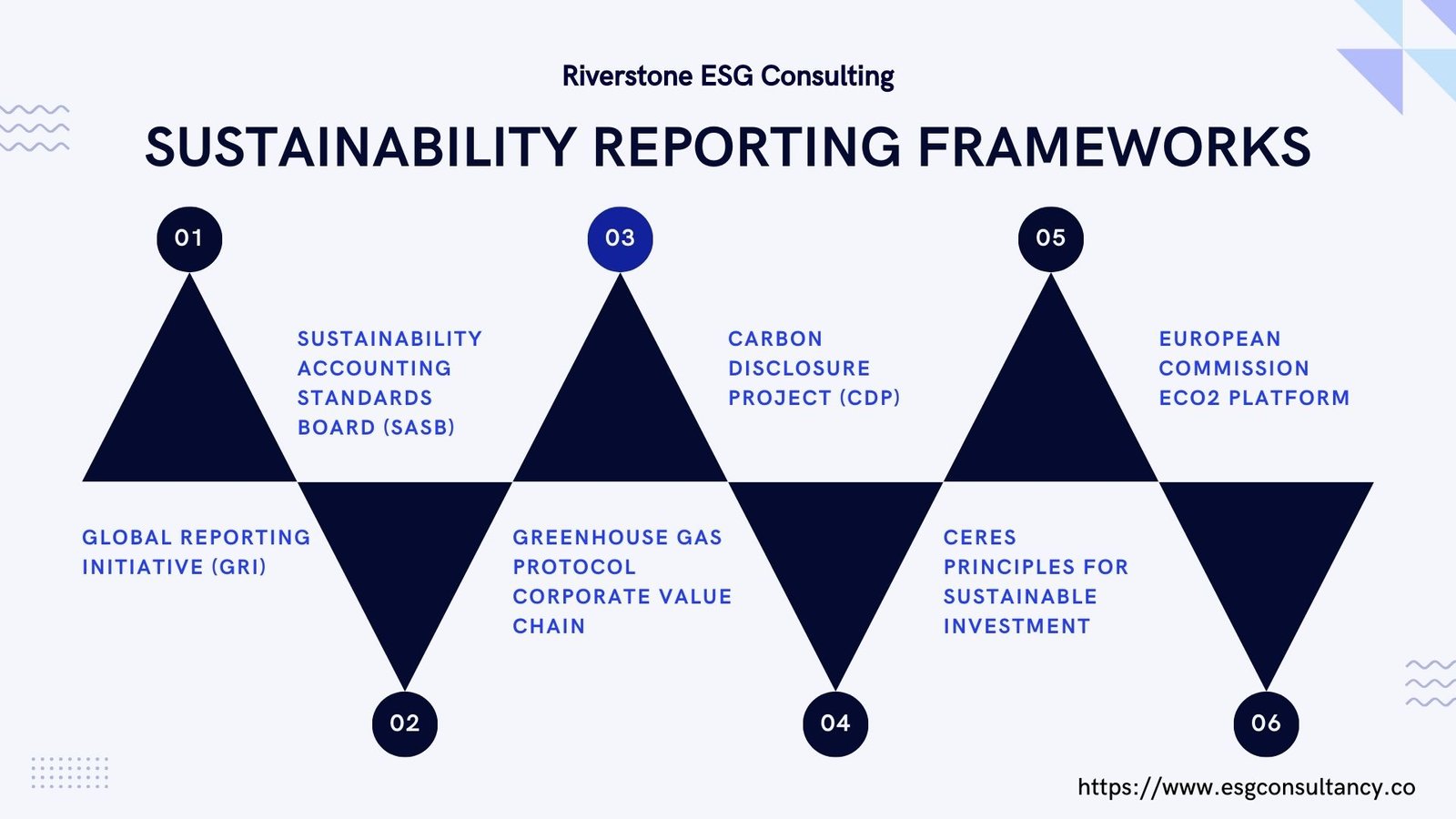

- Sustainability mandatory disclosure:- This involves different countries creating regulatory frameworks for businesses to disclose their environmental data.

- Public pressure on corporations for greater transparency:- Corporations are coming under greater pressure from the public to disclose their environmental, social, and governance data.

- ESG integration by asset managers:- The sixth trend is that asset managers are increasingly integrating ESG into their investment decision-making.

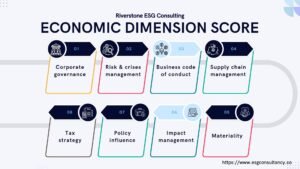

Themes and factors analysis.

When analyzing themes and factors, investors should look at the following:

- Company’s exposure to ESG risks.

- Company’s strengths and weaknesses with regards to ESG.

- How the company compares its peers with regards to ESG.

- The trends affecting the industry and how they impact the company.

- Company’s action to mitigate any potential ESG risks, and address issues related to its plans.

- Positive or negative correlation between financial performance and ESG.

- Available sustainable opportunities that the company could invest in.

- Company’s value alignment with its stakeholders and ESG actions.

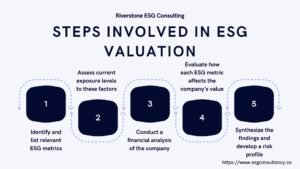

ESG risk management practices.

The following are risk management practices that companies use to manage their exposure to ESG:

- Developing a formal process for identifying, managing, and reporting risks related to ESGs: This involves creating a standardized framework for measuring performance against set targets, principles, or commitments.

- Providing consideration of environmental implications when making investment decisions: Companies are increasing including environmental aspects in their investment decision-making processes by using sustainability metrics such as carbon footprints and green buildings.

- Engaging with non-governmental organizations: This involves businesses establishing a dialogue on important issues with NGOs and other stakeholders.

- Encouraging officers to incorporate ESG factors in their everyday activities. It is also important for senior management to foster an organizational culture that encourages responsible practices such as shared value initiatives or setting emissions reduction targets.

- Establishing sustainability policies and reporting transparency: Implementing guidelines such as policies on conflict minerals as well as publishing comprehensive material regarding the company’s environmental performance, including greenhouse gas emissions.

- Developing a framework for monitoring risks related to ESG: Businesses should have a formal process for identifying relevant risks, reviewing exposure levels, and implementing a formal policy for risk mitigation.