The Role of governance Criteria in ESG Evaluation: A Comprehensive Guide

Evaluation of the governance factors of ESG.

The governance criteria comprise good governance and its classification. The governance factors deal on the following;

- It deals with company policies and governance.

- It focuses on the standards used in running a company.

- It pertains to making the rights, responsibilities, and expectations obvious for stakeholders to achieve interest.

- Governance consists of a list of laws and policies that affect people’s administration and control in a corporation.

- It also involves the relationship among stakeholders in a corporation and their goals.

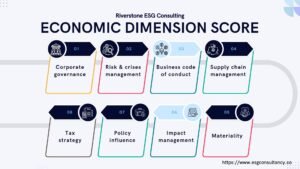

Economic dimension score

This is simply the governance score that evaluates a company’s governance performance, management quality, and ability to handle risks and opportunities. It comprises eight criteria:

- Corporate governance:- Evaluates the system that ensures that the management of a company is committed to its stakeholders’ interests.

- Risk and crises management:- examines the organization of a company’s risk management and how effective it is.

- Business code of conduct:- addresses a company’s codes of conduct and whether it prevents bribery and corruption.

- Supply chain management:- it includes plans and strategies imposed by companies on how to manage associated supply chain risks and opportunities.

- Tax strategy:- it investigates companies’ approach to tax issues and their awareness of risks associated with their tax practice.

- Policy influence:- It is concerned with the evaluation of monetary allocations by companies to organizations involved in influencing public policy.

- Impact management:- it assesses the company’s involvement in social needs. It examines whether a company has a setup program like strategic social needs that covers society needs.

- Materiality:- it assesses a company’s ability to understand and identify long-term issues, value creation, metrics, and business cases and to make them public.

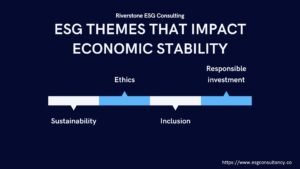

Governance themes and issues

To keep up with responsible governance and responsible, being observant is required in regard to these issues:

- Corporate governance has to do with ownership and control, board diversity, executive pay, and accountability.

- The corporate structure deals with business ethics, financial system instability, tax transparency, and anti-competitive practices.

Impacts of governance on business

The impact of the governance factors is seen in the following areas.

- The effectiveness of management:- low ranked companies on governance practices are more involved with mismanagement and less likely to reduce risks.

- Workforce productivity:- companies with diverse workplaces have higher productivity rates, increase and effective performance, and higher commitment by their employees.

- Investors’ confidence:- the relationship between responsible governance, value creation, and removal of risk is very impotent. High governance scores are the necessity for the rise in institutional investors.

What companies need to improve

Companies that work in improving their corporate governance framework should also work on the following:

- Boosting board diversity and indication.

- Making sure that the compliance function is strong.

- Supporting risk management processes and securing the reporting lines.

- Creating an avenue that guarantees stakeholders’ engagement.