Navigating the ESG Investment Space: Opportunities and Challenges

Opportunities, Threats, and Challenges of ESG Investing

There are a number of opportunities, threats, and challenges associated with ESG investing.

Opportunities:

- Firms that focus on environmental and social issues may have an edge over their competitors in terms of innovation.

- There is a growing demand for ESG products and services, which provides companies with a potential market to tap into.

Threats:

- Regulations related to environmental and social issues could change, making it more difficult for firms to operate.

- Competitors may catch up in terms of integrating ESG criteria into their operations.

- The process of integrating ESG into investment decisions is new, and there are no proven methodologies in place.

- Many traditional financial metrics don’t capture the performance of companies with superior ESG records.

Challenges:

- It can be difficult to measure the impact of ESG factors on financial performance.

- Some investors remain skeptical about the benefits of ESG integration.

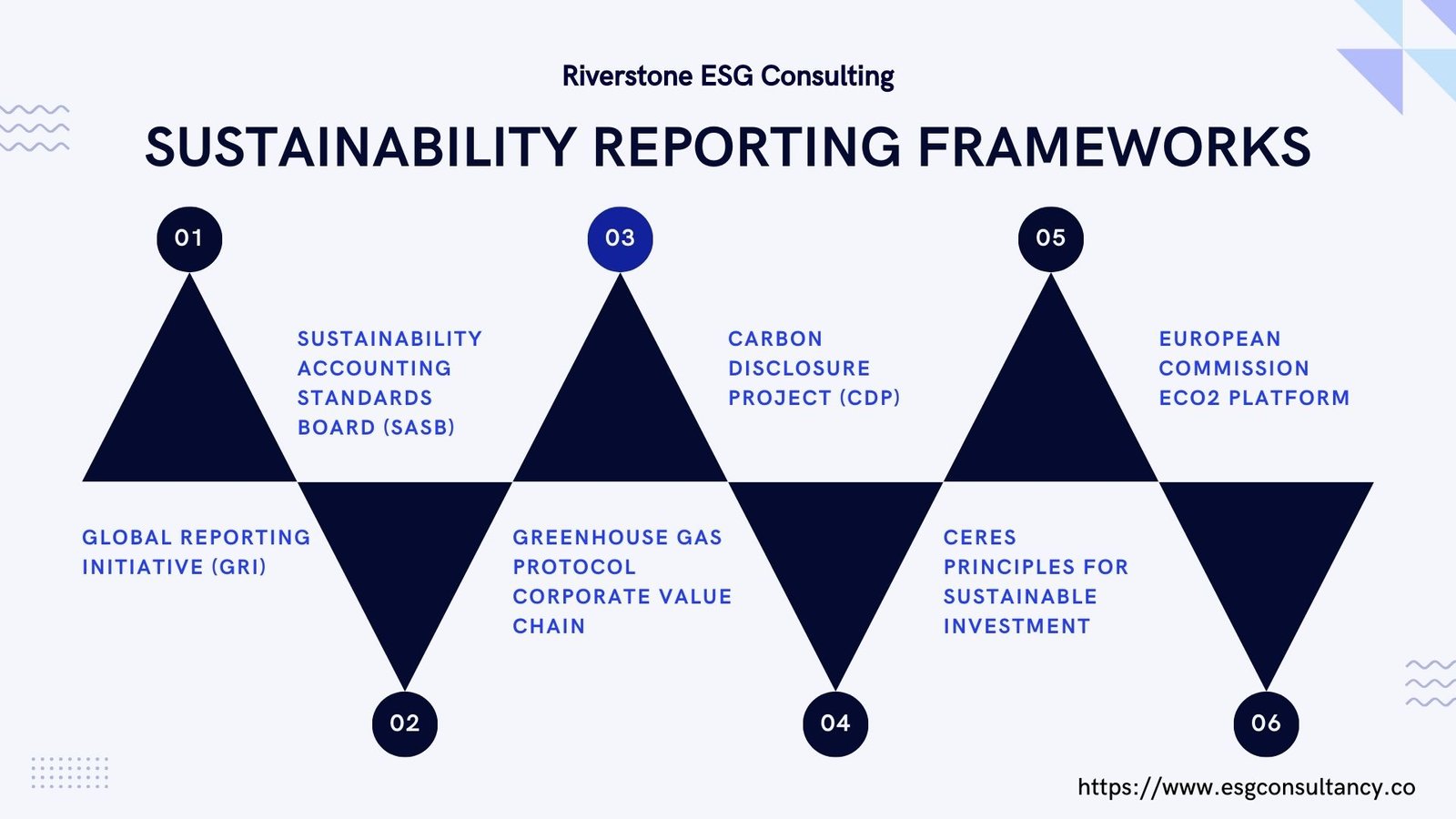

- There is a lack of standardization in the reporting of ESG data.

- The landscape for ESG investing is constantly evolving, and it can be difficult to keep up with developments that could affect the strategy of an ESG portfolio.

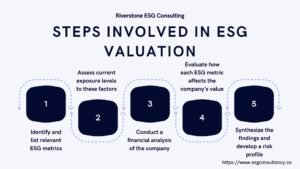

- How to Integrate ESG Factors into Investment Decisions.

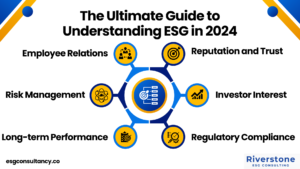

The Value of Sustainable Investing

There are a number of reasons to invest sustainably, including the potential for improved financial performance and reduced risk.

- Financial Performance:- Many studies have shown that sustainable investments perform as well or better than traditional investments over the long term.

- Reduced Risk:

- Sustainable investing takes into account environmental, social, and governance (ESG) factors, which can help identify potential risks and opportunities.

- This holistic view of a company can help investors avoid risks that may not be captured by traditional analysis.

- Ethical Considerations:- Some investors choose to invest sustainably because they believe it is the right thing to do. They may feel that supporting with strong ESG records is more ethical.