Navigating ESG Regulations: What Companies Need to Know

ESG Standards and Regulations

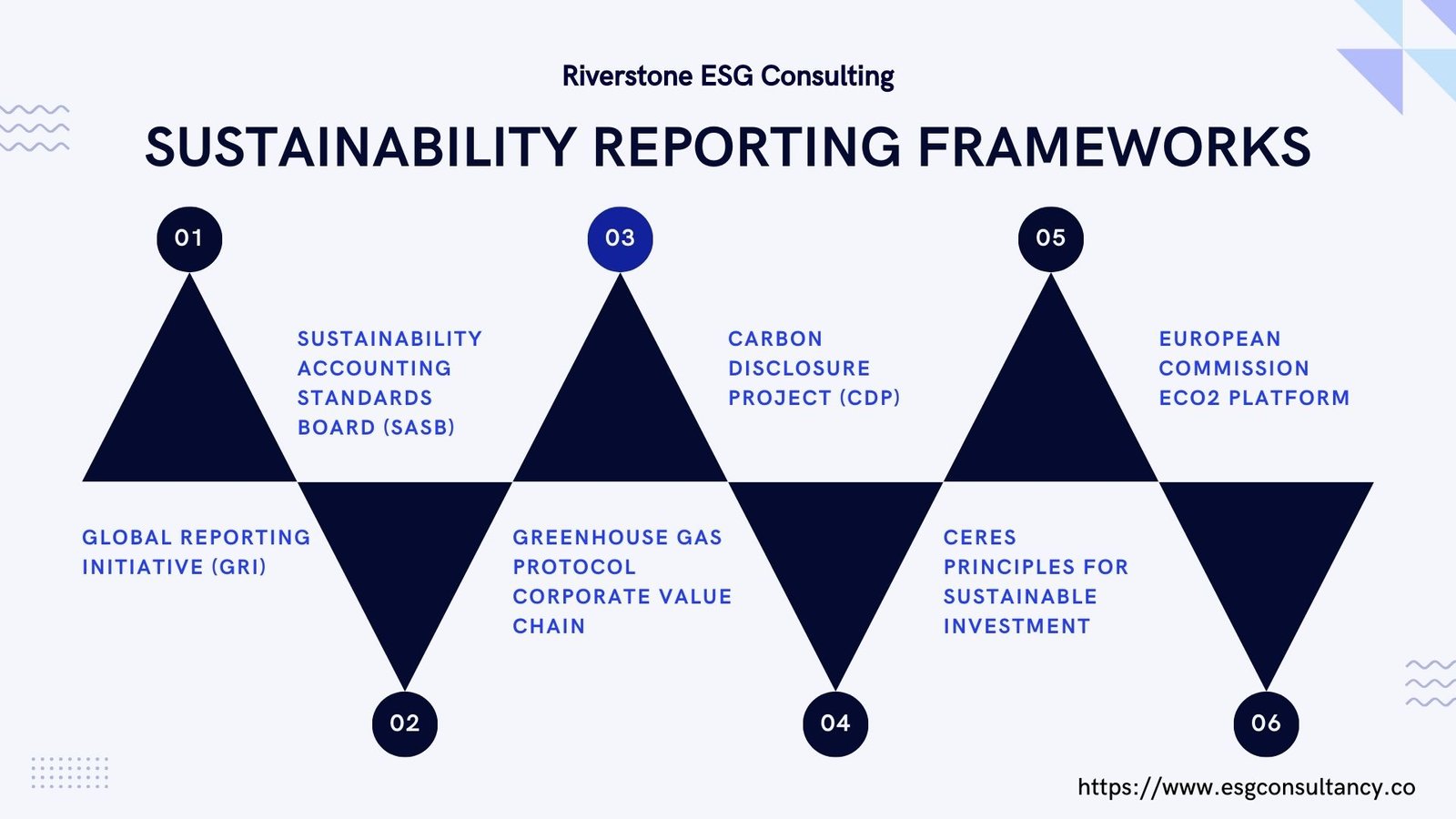

There is a lack of standardization in the reporting of ESG data. This can make it difficult to compare companies and identify the best investments. However, there are regulatory bodies responsible for standard development for ESG:

Global Reporting Initiative (GRI) Standard

- The Global Reporting Initiative (GRI) is a global organization that develops standards for sustainability reporting.

- Their Standards are used by organizations in over 150 countries.

Sustainability Accounting Standards Board (SASB) Standard

- The Sustainability Accounting Standards Board (SASB) is a US-based organization that develops accounting standards for environmental, social, and governance information.

- Their standards are used by public companies in the United States.

Financial Conduct Authority (FCA)

- The Financial Conduct Authority (FCA) is a UK-based regulatory body that oversees financial services.

- The FCA has released guidance on how companies should disclose ESG information.

Securities and Exchange Commission (SEC)

- The Securities and Exchange Commission (SEC) is a US-based regulatory body that oversees the securities industry.

- The SEC has released guidance on how public companies should disclose ESG information.

Joint Forum of Financial Regulators

- The Joint Forum of Financial Regulators is a global organization that helps harmonize financial regulation.

- One of their mandates is to develop guidance on the disclosure of environmental, social, and governance information.

Socially Responsible Mutual Funds

- Socially responsible mutual funds invest in companies with strong ESG records.

- Examples include the Calvert Social Investment Fund and Pax MSCI ESG Leaders Index Fund.

Socially Responsible ETFs:

- Socially responsible ETFs are similar to mutual funds but are traded on an exchange like stocks.

- The Vanguard FTSE Social Index Fund is an example of a socially responsible ETF that invests in companies with strong ESG standards.

- You can also access sustainable investments through professional advice from your financial advisor or bank manager.

- They may be able to provide you with (or help you find) investment products such as SRI funds and ETFs that meet your specific criteria.

The Benefits of an ESG Certification

There are a number of benefits to obtaining an ESG certification.

- Increased Visibility:- Organizations that have an ESG certification are more likely to be visible to consumers and investors. This is because they have met a set of rigorous standards for sustainability.

- Third-Party Validation:- An ESG certification is a sign that your organization has been independently verified as meeting high standards for sustainability. This can help you build trust with consumers and investors.

- Other benefits include:

- Increased knowledge about ESG and being ahead of peers.

- Skills development and being competent to discharge duties and responsible investment mandates.

- Gaining recognition that distinguishes you from other firms.