Guidelines for ESG Portfolio Investment and Management

General Overview

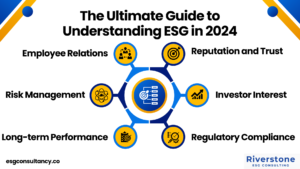

- ESG factors are increasingly important for institutional investors when making investment decisions.

- Implementation of an ESG strategy can help reduce overall portfolio risk and improve performance.

- A growing number of asset managers are offering products that track indexes that focus on companies with good environmental and social practices, also known as sustainable or responsible investing (SRI) funds.

- Some investors use negative screening to remove certain types of investments from their portfolios, such as weapons manufacturers or fossil fuel companies.

- Many investors believe that incorporating environmental, social, and governance criteria into investment analysis will lead to better decision-making and a more sustainable economy in the long run.

What is ESG Investment?

- ESG investments are those that take into account environmental, social, and governance criteria when making investment decisions.

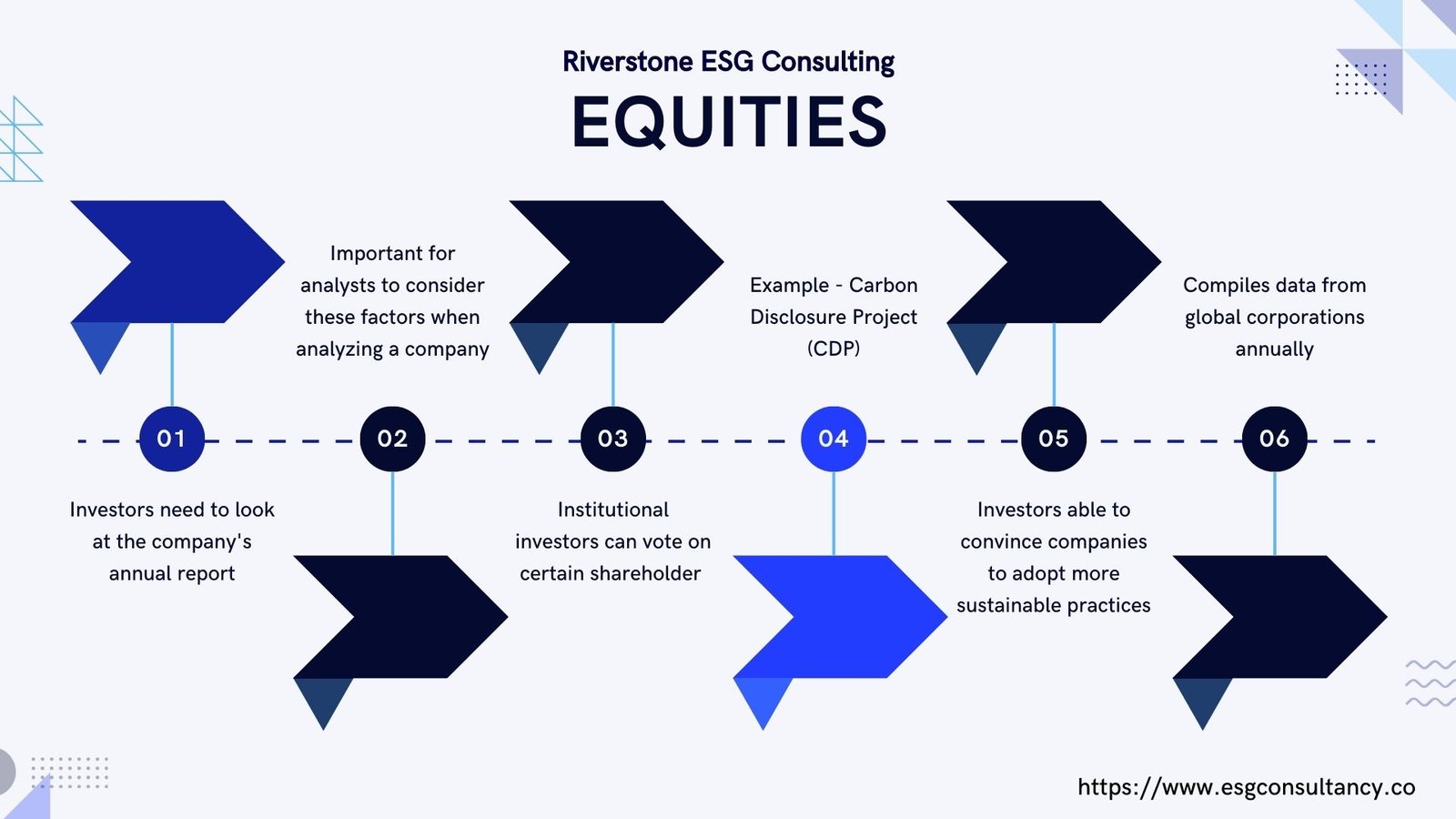

- There are many different types of ESG investments, including sustainable or responsible investing (SRI) funds, negative screening, and shareholder activism.

- ESG investments can be made in stocks, bonds, mutual funds, exchange-traded funds (ETFs), and private equity.

- Institutional investors, such as foundations and pension funds, are increasingly looking to divest from companies that pose a risk to the environment or social welfare.

Why ESG Investment is Important.

- Institutional investors are increasingly looking to incorporate ESG factors into their investment decisions.

- The negative impact of climate change is being felt not only by society as a whole but also by individual companies’ bottom line.

- These costs include increased risk premiums, damage from extreme weather conditions such as storms and flooding, or liability claims arising from accidents such as oil spills.

- Although financial markets do not currently value climate-related risks and opportunities directly at securities prices, they will be incorporated indirectly as these physical impacts translate into changes in earnings and cash flows that affect valuations.

- It has been estimated that achieving no further global warming would avoid about $20 trillion in damages every year.

Safeguarding of Investments

A growing number of investors are looking to social and environmental issues when making investment decisions. Let’s explore more on the safeguarding processes.

- Implementation of an ESG strategy can lead to improved performance, lower costs (due to less waste and better efficiencies), increased market share, and enhanced brand equity.

- Institutional investors want their portfolios to reflect the full range of risks that companies face.

- A large proportion of funds available for institutional investors are managed by asset management firms.

- It has been estimated that achieving no further global warming would avoid about $20 trillion in damages every year.

- Many investors believe that incorporating environmental, social, and governance criteria into investment analysis will lead to better decision-making and a more sustainable economy in the long run.

- Institutional investors want their portfolios to reflect the full range of risks that companies face.

- The global warming potential of methane is 25 times greater than carbon dioxide over 100 years.

- Some investors choose not to invest in tobacco or weapons stocks as they see these as unethical investments.

- It is estimated that if all institutional funds followed an ESG approach, it would help create up to $1 trillion in market value for companies across seven key industries – oil and gas; mining; metals and minerals; food and beverages; autos; banks; and insurance.

ESG investment management

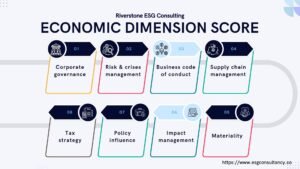

- ESG Management is a method used by companies to create a positive impact on the environment and society while maintaining bottom-line profitability.?

- It uses information about – and insights into – environmental concerns and socially responsible business practices to improve operational performance, financial results, and shareholder value.

Responsible ESG investment and Management

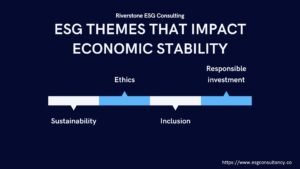

- Responsible investing is an investment philosophy that supports companies that are committed to ESG management.

- It is a proactive, positive approach used by investors to encourage companies to better manage environmental and social challenges.

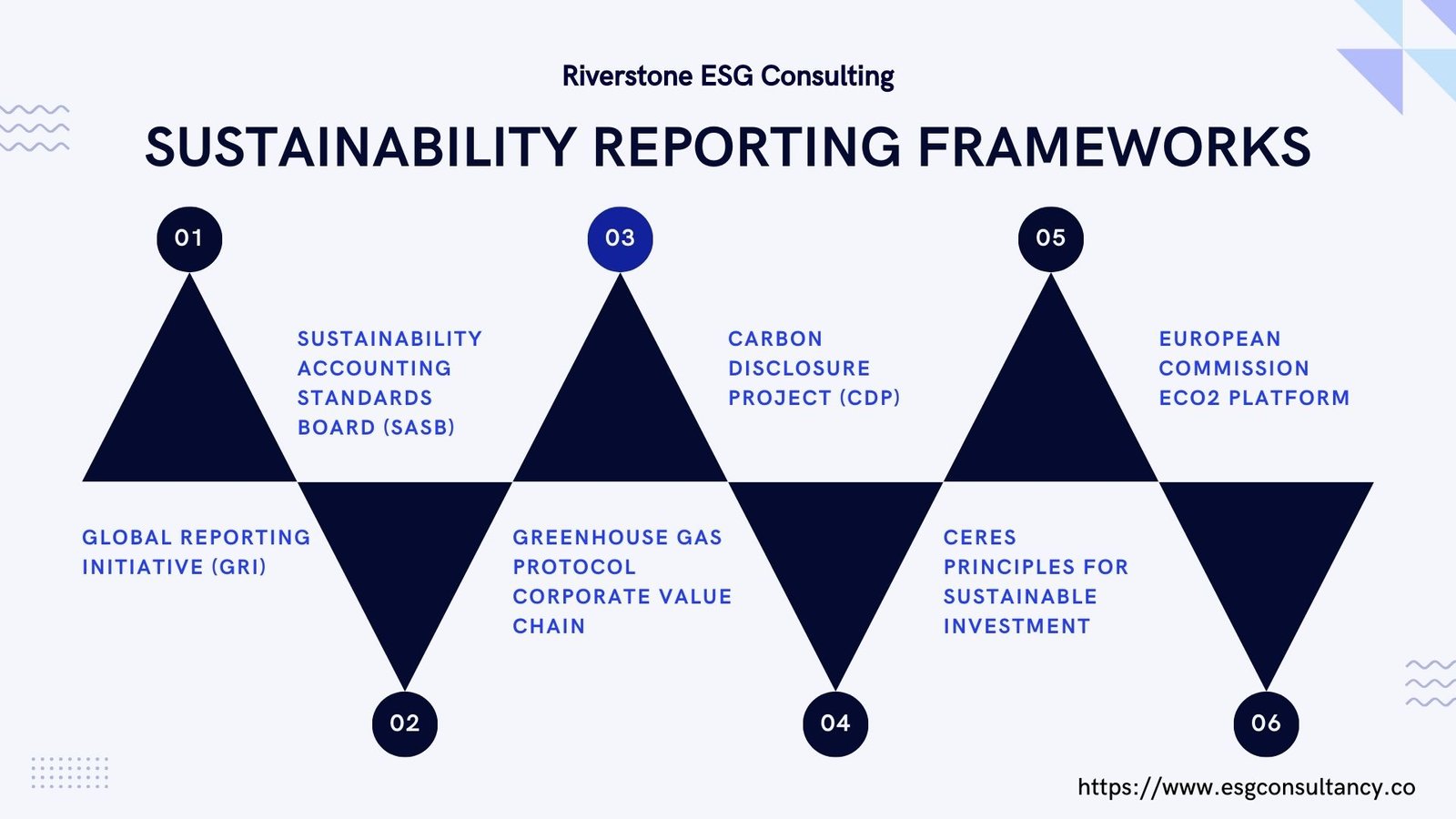

- Responsible investments are conscious of ESG issues. They have three main steps: measuring, mitigating, and reporting.

- A regular review of the company will assess how it has dealt with its relationship with stakeholders in the past six months.

- This includes analyzing their human rights policies, health & safety records, business ethics policies, community involvement activities, and other impacts on society.

ESG investment strategies

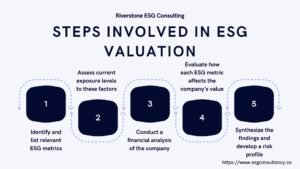

- There are five primary strategies involved in ESG investing.

- These strategies show various motives that involve the avoidance of ESG and yielding higher returns on investment.

- The five identified ESG strategies are:

- Exclusionary screening.

- Positive screening.

- ESG integration.

- Impact investing and,

- Active ownership.

Need to Address Climate Change

- The physical impacts of climate change are already being felt by companies, and these are likely to increase in the future as global temperatures continue to rise.

- Ecosystems are changing, natural disasters are becoming more common, and extreme weather conditions are causing major disruptions to businesses.

- In addition, there is a significant financial risk associated with climate change, as it could lead to a loss in earnings and cash flows for companies.

- A growing number of investors are looking at social and environmental issues when making investment decisions.

- They realize that implementation of an ESG strategy can lead to improved performance, lower costs (due to less waste and better efficiencies), increased market share, and enhanced brand equity.

- Institutional investors are beginning to follow this trend, for both ethical and financial reasons.

- They are realizing that focusing on ESG criteria can help them create value in the long run.