Guide to Implementing Sustainable ESG Investment Strategies

Development of ESG Investment Guidelines/strategies

- Many investors now have their ESG guidelines, which outline the specific environmental and social issues they will not invest in.

- Many organizations provide best-practice guidelines for responsible investment.

- These organizations come from a variety of backgrounds, including religious groups, labor unions, and environmental organizations.

- The UN Principles for Responsible Investment (PRI) is one of the most well-known sets of guidelines.

- It is a global initiative that has over 1,500 signatories, which represent more than $56 trillion in assets.

Key principles for responsible investment:

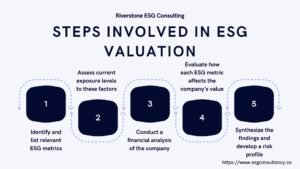

- Incorporating ESG issues into our investment analysis and decision-making processes.

- Being active owners and incorporating ESG issues into our ownership policies and practices.

- Seeking appropriate disclosure on ESG issues by the entities in which we invest.

- Promoting acceptance and implementation of the Principles within the investment industry, as well as broader global policy-making initiatives.

- Working together to enhance effectiveness in implementing these Principles.

- Committing to regular self-evaluation against this Statement of Principles and continued improvement of how to integrate ESG issues into investment decisions and practices.

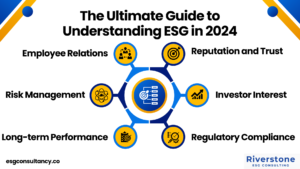

How ESG Investing Helps You Achieve Your Financial Goal

ESG investing is based on the belief that companies with good ESG records are better investments. Improving your ESG score can help you achieve your financial goals in a number of ways:

- Reduced Risk:- Companies with strong ESG records are less likely to experience major financial setbacks. This is because:

- They are better managed and have fewer governance issues.

- In addition, their products and services are often more in demand by consumers and investors.

- Increased Returns:- Many studies have shown that companies with good ESG records outperform their peers over the long term. This is due to a number of factors, including reduced risk, increased innovation, and improved brand reputation.

- Finding Opportunities:- ESG investing can help you find new investment opportunities. Many companies with strong ESG records are undervalued by traditional financial metrics. This means that they may offer good investment potential.

Investing for a Better World:

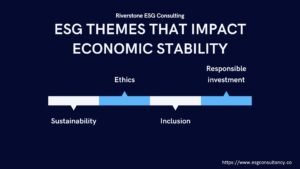

- Many investors believe that sustainable investing can help create a better world.

- They see it as an opportunity to make a positive impact on the environment and society while achieving financial returns.

Sustainable Investing Goes Mainstream

- A number of factors are contributing to the growing popularity of sustainable investing.

- There is an increasing demand from investors for products and services that reflect their values.

- The financial crisis has made people more aware of the risks associated with environmental, social, and governance issues.

- Technology has made it easier for investors to access information about companies’ ESG performance.

- Institutional investors are increasingly allocating money to sustainable investments.

- The bottom line is that there are a number of opportunities, threats, and challenges associated with ESG investing.

- How you decide to integrate these factors into your investment decisions will depend on your specific circumstances and objectives.