Guide to ESG and Sustainable Finance for beginners

The Future for ESG and Sustainable Finance

- The future of ESG and sustainable finance is bright.

- Organizations that implement ESG policies are more likely to be successful in the long run.

- The growth of sustainable finance will help to drive this trend.

Sustainable finance investment

There are a number of ways that you can invest in sustainable finance.

- Stocks:- You can invest directly in companies that implement ESG policies. For example, the Julius Baer Group is a Swiss financial services provider that has implemented a comprehensive set of Sustainability Measures.

- Funds:- You can invest in funds that focus on sustainable finance and/or ESG principles. Examples include the Impax Environmental Markets Fund and the SPDR S&P 500 Fossil Fuel Resistance ETF.

- Exchanges:- You can invest in sustainable finance through exchanges such as the London Stock Exchange and Nasdaq.

- Certifications:- You can obtain an ESG certification to show that your organization meets rigorous standards for sustainability and corporate responsibility. For example,

- The London Stock Exchange Group and HSBC have both obtained an ESG certification from EIRIS.

- You can also invest in sustainable finance through professional advice from your financial advisor or bank manager.

- You can do this by implementing environmental, social, and governance policies at both your business and personal levels.

Top 3 Reasons to Invest in Sustainable Finance

- Sustainable finance will help to drive long-term growth in your business.

- You can invest in sustainable finance through a number of channels.

- You can easily implement ESG policies at both your business and personal levels.

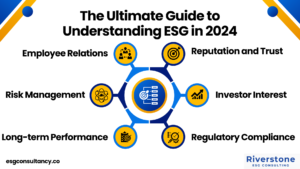

ESG Status Today

- The landscape for ESG has shifted dramatically in recent years.

- In 2007, only a handful of companies disclosed any information about their ESG performance.

- Today, over 2,000 companies disclose this information in some form.

- This is largely due to the work of financial regulators who have developed guidance on the disclosure of environmental, social, and governance policies.

- The Financial Stability Board’s Task Force on Climate-related Financial Disclosures is an example of this work in practice.

- You can obtain an ESG certification to show that your organization meets rigorous standards for sustainability and corporate responsibility.

- An ESG certification is a sign that your organization has been independently verified as meeting high standards for sustainability.

- Organizations that have an ESG certification are more likely to be visible to consumers and investors.

Evolving Policies and Trends in Sustainable Finance

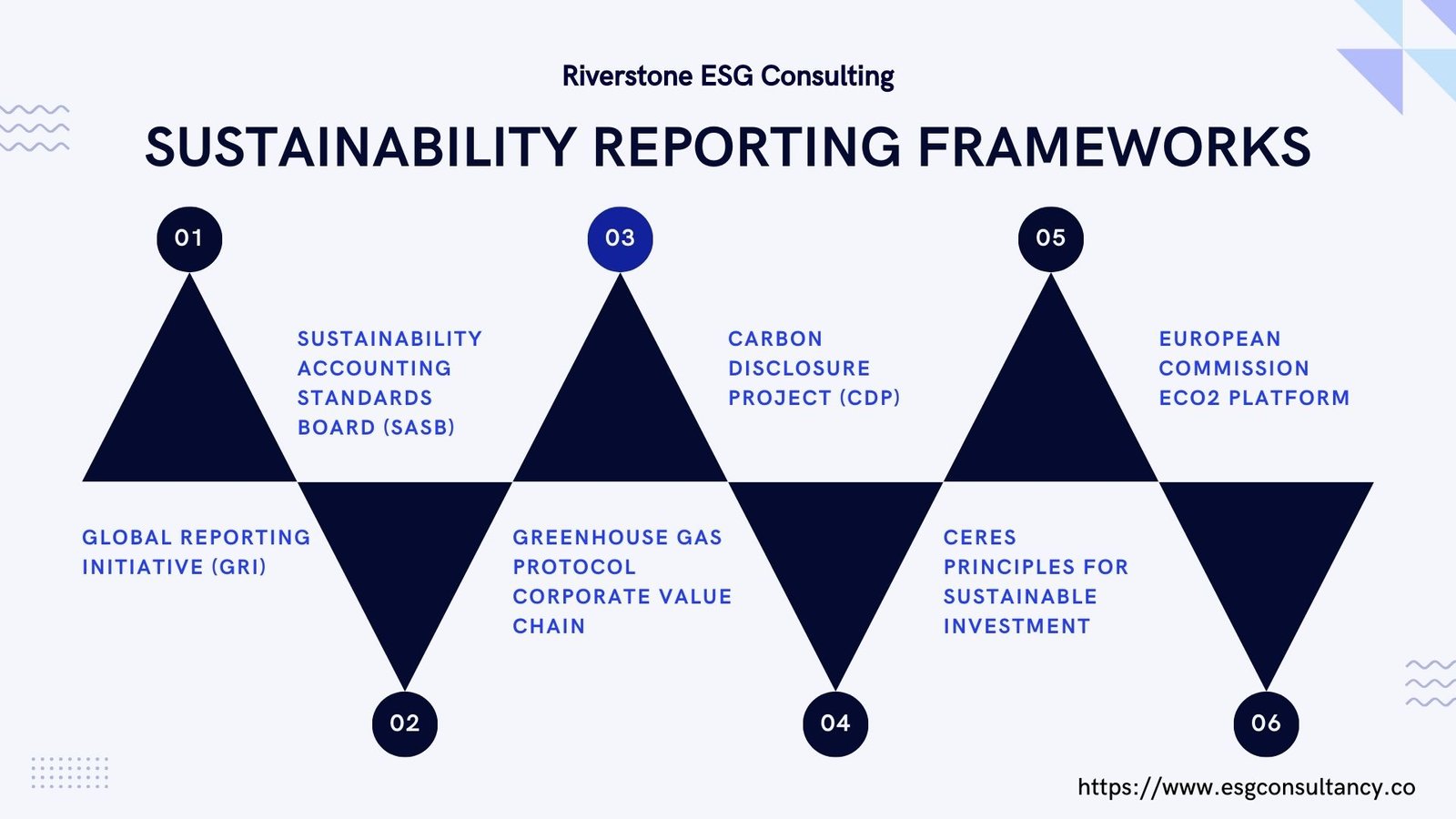

Financial regulators have published guidance on the disclosure of environmental, social, and governance policies. Details are as follows:

- Some examples are the International Organization for Standardization’s ISO 26000 Principles of Social Responsibility and the Global Reporting Initiative G4 Guidelines.

- These standards provide organizations with a framework for identifying and controlling risks in their ESG performance.

- The Financial Stability Board has also published guidance on the disclosure of environmental, social, and governance policies.

- This includes the Task Force on Climate-related Financial Disclosures and the Task Force on Disclosure Standards for Fossil Fuel companies.

- In 2015, China announced that it would introduce a nationwide ETS in 2017.

- In 2016, the G20 nations agreed to develop green finance strategies and to work with the private sector, international organizations, and financial regulators to invest in sustainable finance.

- This was followed up in 2017 with a commitment to developing green finance strategies by the G7 nations.

- Other countries, including South Korea and Australia, have also committed to investing in sustainable finance. Some regions are taking an international approach to promote sustainable finance.

- The European Union adopted the Restriction of Hazardous Substances Directive, which bans the use of certain hazardous chemicals in electrical and electronic equipment starting in 2020.

Paris Agreement: what is it?

The Paris Agreement is an agreement within the United Nations Framework Convention on Climate Change (UNFCCC). It aims at:

- Strengthening the global response to the threat of climate change by keeping a global temperature rise this century well below 2 degrees Celsius above pre-industrial levels.

- Significantly reducing risks and impacts of climate change.

- The Paris Agreement was adopted by consensus on 12 December 2015.

- It entered into force on 4 November 2016 after 55 countries and entities had ratified the agreement.

Recent FSC Report on Sustainability

What the recent FSC report on sustainability tells us:

- The FSC report on sustainability provides an overview of the current state of sustainable finance.

- It examines how different financial market actors are responding to climate change and other environmental, social, and governance issues.

- The report also looks at the barriers to greater uptake of sustainable finance.

Some key findings from the report include:

- The current state of sustainable finance is still in its early stages, with most activity taking place in the developed world.

- There is a lack of standardization around what constitutes “sustainable finance.”

- Lack of awareness and understanding are key barriers to greater uptake of sustainable finance.

- Financial market actors are starting to respond to climate change and other ESG issues, but more action is needed.

- Barriers to greater uptake of sustainable finance include lack of awareness, risk aversion, and a lack of standardization.

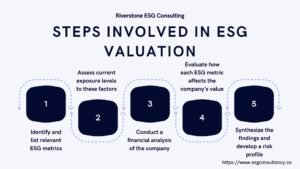

How to Adopt a Sustainable Financing Policy

There is no one-size-fits-all approach to adopting a sustainable financing policy. However, there are a few key steps that can help governments and financial market actors shift toward sustainable finance:

- Awareness and Understanding:- Financial market actors need to be aware of the concept of sustainable finance and understand how it works.

- Education:-Financial market actors also need to be educated on the various environmental, social, and governance issues that affect their industry.

- Standardization:- There needs to be standardization around what constitutes “sustainable finance.” This could include developing global standards or regional/national standards.

- Regulatory Support:- Governments can play a role in encouraging the uptake of sustainable finance by developing regulations that promote sustainable finance.

- Green Investment Incentives:- Governments can also encourage the adoption of green investment options by offering incentives for financial managers to choose these types of investments over unsustainable ones.

- Disclosure:- Financial market actors need to be transparent about their ESG policies and practices so investors can make more informed decisions about which companies to invest in.