The Impact of ESG themes and Factors on Investment Decisions

ESG Themes and Factors

- When looking at an ESG Marketplace, it is important to be aware of the different themes and factors that are considered.

- Each exchange has its focus, so it is important to do your research before investing.

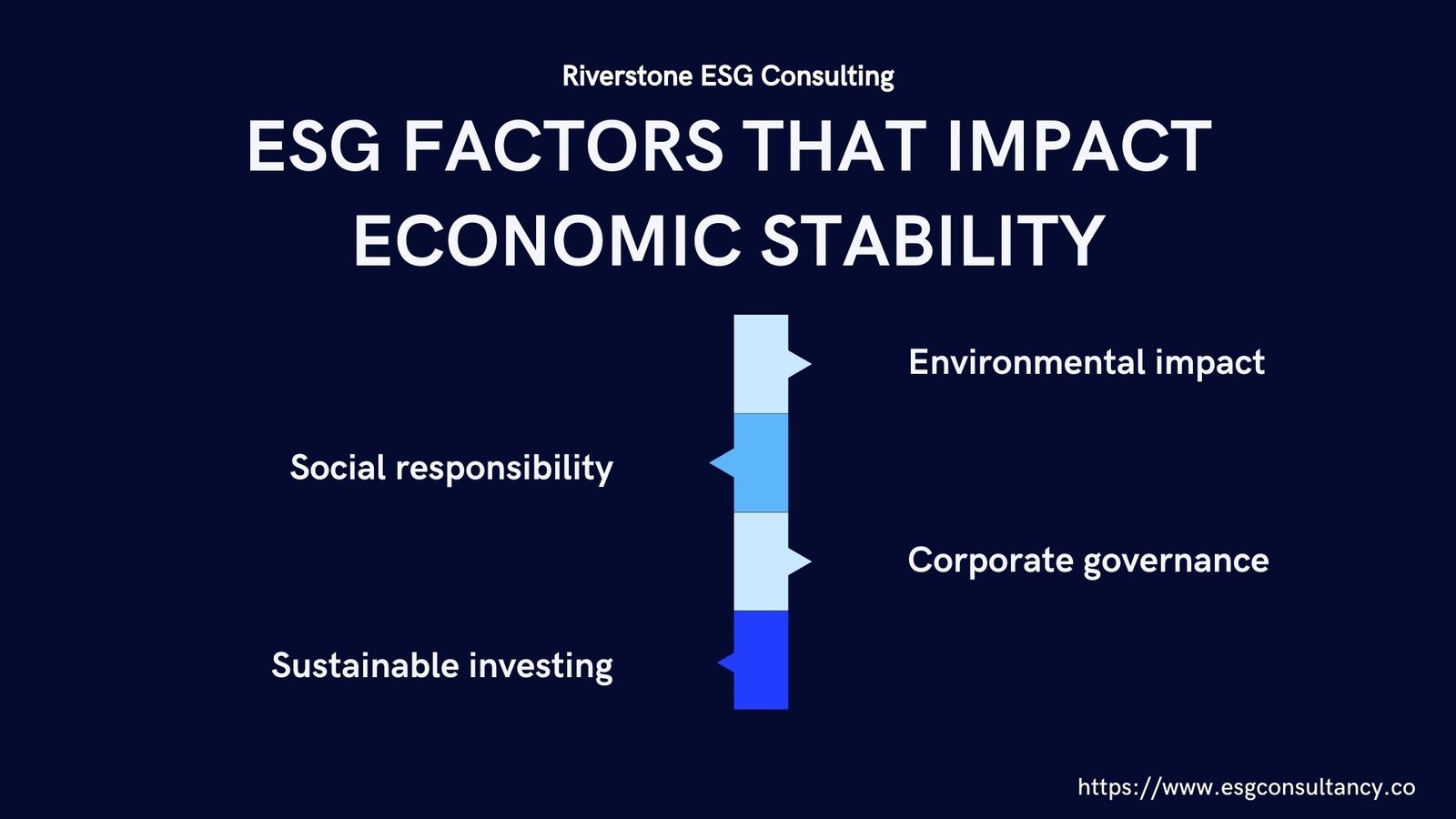

4 ESG factors that impact economic stability.

The following are the four main factors that ESG focuses on to increase economic stability.

- Environmental impact:- The first factor is to consider how environmental factors affect the growth of a company.

- Social responsibility:- The second factor is to ensure social factors do not impact growth negatively.

- Corporate governance:- The third factor is to ensure internal controls will not hinder stability, which includes consistency and transparency within the company’s decision-making process.

- Sustainable investing:- The fourth factor looks at companies with strong practices in renewable resources, clean technology, and corporate sustainability initiatives.

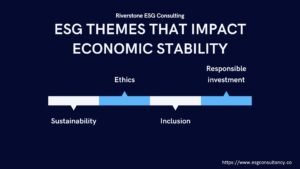

THE 4 ESG themes that impact economic stability.

The following are four themes that impact economic stability.

- Sustainability:- Addressing environmental and social concerns today to ensure future economic stability.

- Ethics:- Acting with integrity and in accordance with ethical principles.

- Inclusion:- Promoting diversity and equal opportunity both within the company and among its stakeholders

- Responsible investment:- Seeking opportunities that consider environmental, social, and governance factors when making investments decisions?

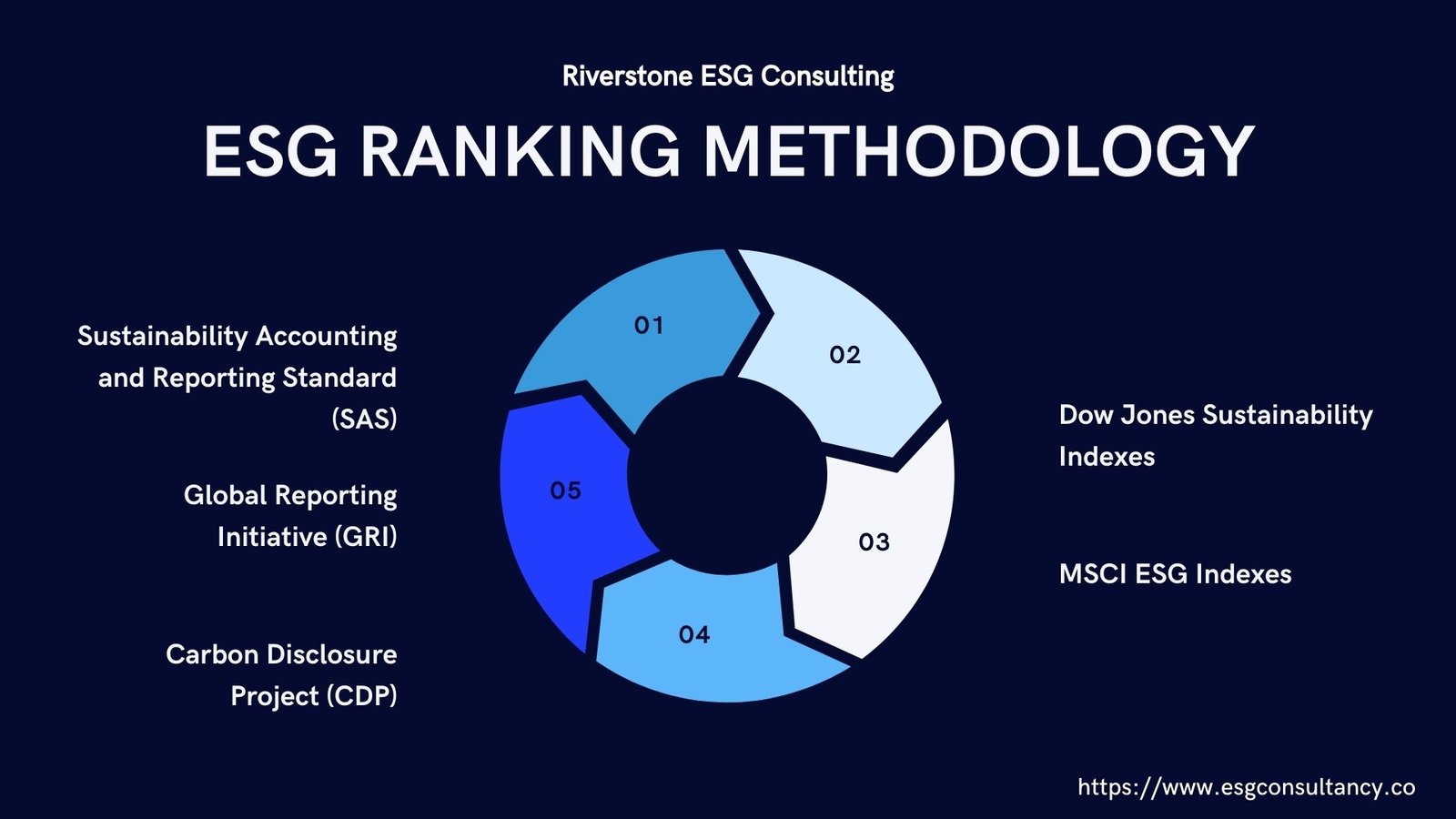

ESG ranking methodology

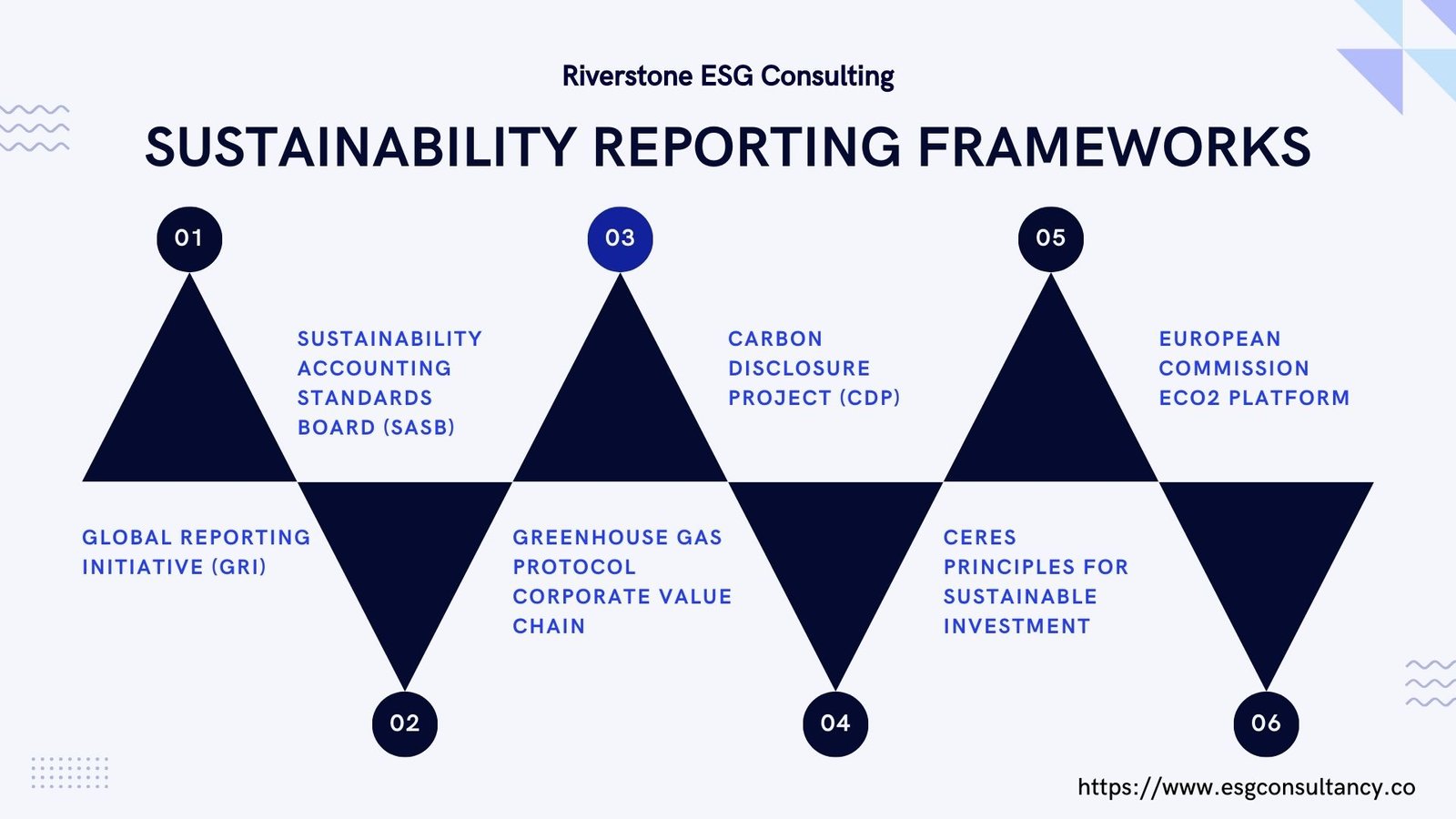

There are different methodologies used in different exchanges. Let explore some examples of how different exchanges rank companies according to their ESG performance.

- Sustainability Accounting and Reporting Standard (SAS):- This is used by the SASB, which is an organization that provides sustainability reporting standards for publicly traded companies in the US.

- Global Reporting Initiative (GRI):- The GRI is an international organization that develops guidelines for sustainability reporting.

- Carbon Disclosure Project (CDP):- The CDP is a global nonprofit organization that asks companies to disclose their environmental data.

- Dow Jones Sustainability Indexes:- DJSI is a stock market index provider that tracks the performance of sustainable companies.

- MSCI ESG Indexes:- MSCI is a provider of indexes and portfolio risk and performance analytics.

ESG factors in investment

Here are the things to know about ESG factors in investments.

- ESG factors also impact financial performance.

-

- It is important to note that companies with strong ESG practices may see a positive correlation between their ESG and financial performance, as opposed to the negative trend associated with non-ESG companies.

- Not all indexes use the same methodology:

-

- It is important to check the credibility of your source before you invest based on rankings from an index provider since not all indices use the same grading methodologies

- Investments in renewable resources are growing rapidly:

-

- The growth of investments in sustainable resource factors has increased substantially in recent years.