The Ultimate Guide to Understanding ESG in 2024

What is ESG all about?

- ESG is the acronym for Environmental, Social, and Governance.

- ESG is defined as a company process that involves environmental, social, and governance practices.

- ESG is considered a non-financial factor applied in the investment analysis process by investors.

- Investment management in recent years has considered ESG a very important topic.

- The three broad categories are generally termed ‘socially responsible investors’.

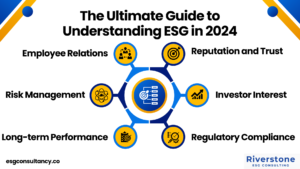

- These investors (ESG) are not only concerned with investment profitability and risk.

- They are concerned about the importance of adding value and incorporating this value into their section of investment.

The Growth of ESG

- In the last few years, ESG has grown exponentially and has become increasingly popular.

- It is most likely to be considered an investment approach used by millennials.

- The financial service industry in response to the growing demand for ESG investment has offered ESG exchange-traded funds.

- The two largest ESG providers known are:

- Black Rock and Vanguard

- They both offer clients an option of ESG funds.

The ESG terms/factors

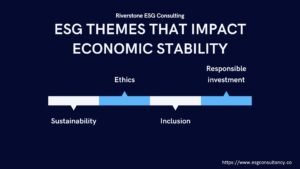

The terms Environmental (ES), Social (SO), and Corporate Governance (CG) are often used interchangeably, but they have specific meanings.

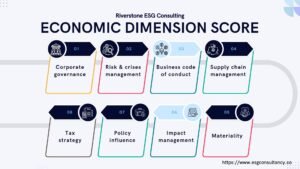

- CG is the process by which a company is directed and controlled.

- SO is the branch of sociology that examines human behavior in social groups.

- ES is the study of how humans interact with their natural environment.

Environmental factors

- The environment includes everything from the air we breathe to the water we drink.

- Companies that pollute or damage the environment can face fines and lawsuits.

Social Factors

- Social factors include things like human rights and labor practices.

- Companies that mistreat their workers or violate human rights can face negative publicity and boycotts.

Corporate Governance

- Corporate governance includes things like board independence, executive compensation, and shareholder rights.

- Poor corporate governance can lead to accounting scandals and bankruptcies.