ESG Strategy, Policy Development and Implementation

There is so much pressure on organizations to handle the increasing environmental, social and governance (ESG) opportunities and risks accordingly. This pressure comes from various parties, including customers, investors, employees and the public. Consequently, businesses require strategies and policies to help them respond to these issues well. Besides responding, there is also a dire need to anticipate them. After all, readiness has a way of making tackling issues a breeze.

Therefore, as far as ESG strategy, policy development and implementation are concerned, no company can afford to get it wrong. Fortunately, you can seek a partner to help you get it right. Riverstone ESG Consulting fits the bill excellently. It helps businesses develop a strategy to integrate ESG into all their processes and operations. It is the only way to handle all this pressure coming right, left and centre.

What We Offer

We have several years of experience in developing effective ESG strategies. We have also helped many businesses implement these impactful strategies for sustainability. Under this category, we have several sections, including the following.

ESG Materiality Assessment

As your company make decisions, it is crucial to ensure that it also monitors their impact on Environmental, Social and Governance (ESG). Which impact, both positive and negative, do these decisions bring? ESG assessment can help measure the firm’s activities, strategies, and policies in this respect. The stakeholders will then use these assessment reports to make decisions and judgments. Despite the complex process, Riverstone ESG Consulting has the team and experience to handle it excellently.

ESG Goal Setting

For any company to understand the best way of managing ESG factors, including their opportunities and risks, setting ESG goals is crucial. The quality of these goals is equally important to bring desirable results. As the best ESG consultants, we will help you figure out the following.

- Is your company protecting its surroundings?

- If yes, how is the progress towards improving the current measures?

- What are the current measures taken by the company to reduce its ecological footprint, pollution and energy consumption?

- How does the company support the local community?

- What about its treatment towards stakeholders, including employees?

- Is the company conducting itself ethically?

- What about compliance and adherence to its policies?

We also ensure all the answers to these questions are positive for the sake of your company.

ESG Policy Development

Your business needs a document to reference when dealing with sustainability issues. That’s where our ESC policy development service comes in. We ensure that your organization has an ESG plan showing the policies it will use to reach its ESG goals. It also shows its commitment to ensuring its processes and operations are sustainable. Such a document makes reporting progress to investors, customers, employees, and other stakeholders easy. We ensure your ESG policy captures every detail of the firm’s operations, management and everything else. We also help you choose an ESG framework since there are quite a few. Some of the frames are reputable ones, such as the Sustainable Development Goals (SDGs) and Global Reporting Initiatives (GRI), to mention a few.

ESG Strategy Development and Implementation

You also need to develop and implement an ESG strategy to earn your stakeholders’ hearts. After all, these individuals, including employees, investors and customers, will benefit your business in the long run. Great implementation of ESG strategies is ideal for marketing as it boosts your brand. You also earn their trust and loyalty, which you can’t afford to ignore. So, help us achieve it through our ESG strategy development and implementation services. We make you the company the regulators and investors are looking for by promoting your sustainability through the right ESG strategies.

ESG Gap Analysis

Upon assessing your ESG policies and strategies, what’s next? As a company, you also need to figure out how you deal with the issues. In other words, you will need an ESG gap analysis. On one side is the materiality assessment of the firm’s ESG issues. On the other hand, one assesses how the company deals with these issues. This performance helps the

ESG Integration

We ensure that your company considers ESG factors. It should consider the environmental, social and governance aspects at all times. Despite being explicit, this inclusion is also systematic for excellence. Every investment or decision it makes should always depend on these aspects. So, let’s help you figure it out.

ESG Stakeholder Involvement

You must engage the company’s stakeholders if you want a strong ESG strategy. After all, stakeholders affect the actions and decisions the company make. Others are affected by the actions taken and decisions made by the organization. As important as it is, it is never easy. Therefore, you may consider our ESG stakeholder engagement services to simplify this complex yet crucial aspect.

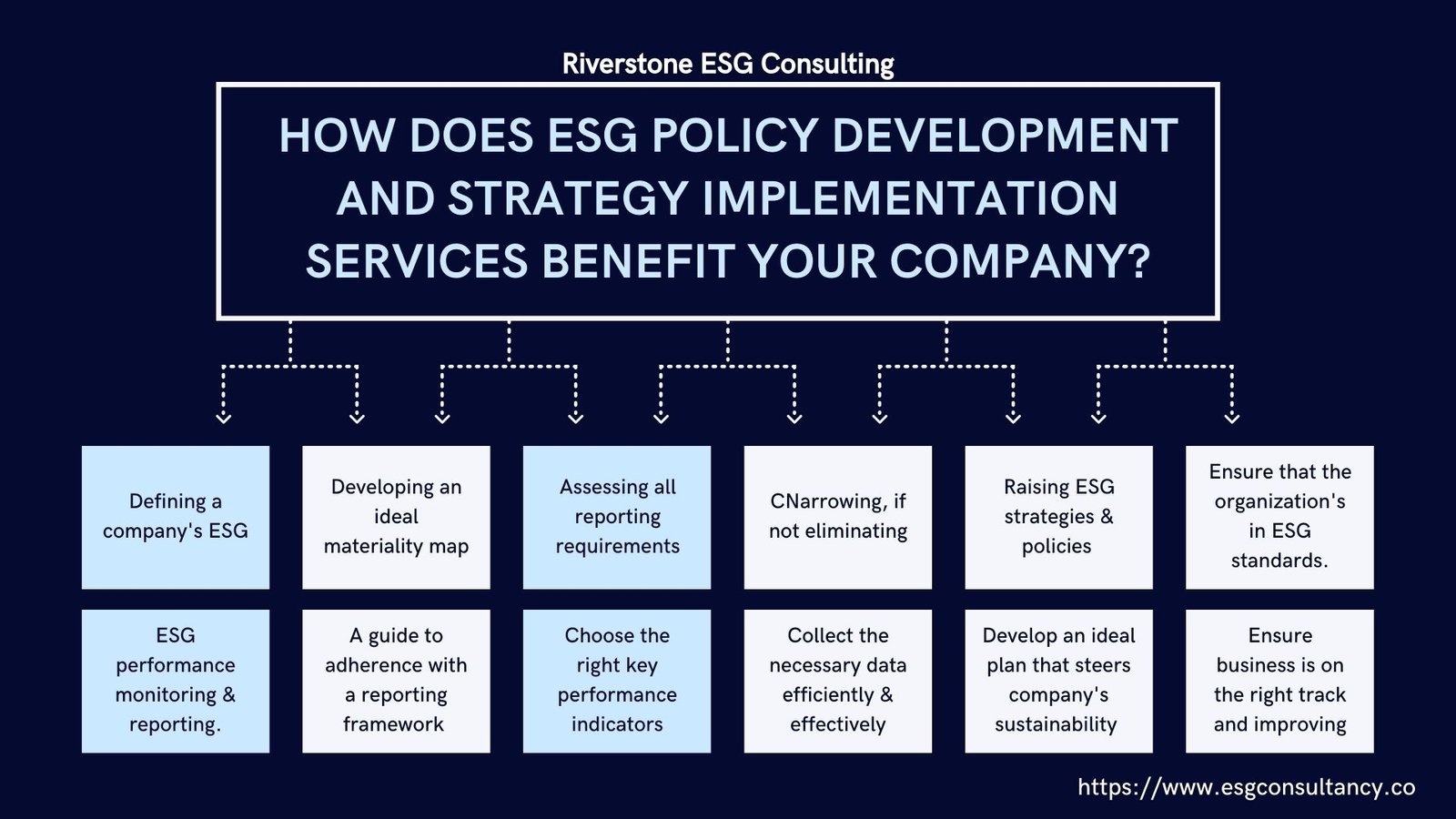

How Does ESG Policy Development and Strategy Implementation Services Benefit Your Company?

If you choose the right partner for your ESG policy development and strategy implementation, you can benefit in the following ways.

- Defining a company’s ESG strategies, methodologies, approaches and targets

- Developing an ideal materiality map to ensure the business meets its target

- Assessing all your reporting requirements for compliance and regulatory purposes

- Narrowing, if not eliminating, the gap between your current ESG status and the one you wish to have

- Raising ESG strategies and policies for employees through training and education.

- Ensure that the organization’s operations and processes are a factor in ESG standards.

- ESG performance monitoring and reporting.

- A guide to adherence with a reporting framework that’s up to the standards

- Choose the right key performance indicators for your ESG plans.

- Collect the necessary data efficiently and effectively since its quality affects the findings and decisions.

- Develop an ideal plan that steers your company’s sustainability in the right direction.

- Review existing ESG statements, policies, and strategies to ensure your business is on the right track and improving where necessary.

Our Approach

As we deliver our ESG strategy and policy development and implementation services, here is our approach to excellence;

Understanding Your Company

Every business has its uniqueness, mission, vision, core values and procedures. That’s why we ensure we understand your company before offering any solution. After all, we can only offer the best solutions that are ideal for your organization.

ESG Analysis

Since our services revolve around environmental, social, and governance issues, we take the time to analyze your status as far as the sector is concerned. What have you achieved, and what’s also pending? What are the company’s opportunities and risks, and how can you use them to your advantage? Only then can we move to the next step and succeed, too.

Developing a Customized ESG Solution

With all that information at our disposal, we develop an ESG solution that suits your firm excellently. It will align with the company’s goals, mission, vision and core values. The same applies to its operations and actions. Equally important, we ensure the solution doesn’t compromise the organization’s performance or profits. Otherwise, what’s the need to set goals that won’t benefit the business or its stakeholders?

Implementation

After creating the ESG plan, the next thing is implementing it. After all, even the greatest solutions are meaningless until you implement them. We develop strategies corresponding to the firm’s ESG goals to help it achieve them. Our experience in the field will ensure that the strategies are effective enough to help the company promote sustainability.

Review

After the implementation of ESG policies and strategies, we will review them occasionally. This review confirms that the ESG solution is ideal for the company. We look at their effectiveness in the company’s progress towards achieving these goals.

Adjustments

If the results of the review leave a lot to be desired, we will make the necessary adjustments immediately. It has helped us figure out the best ESG solution for one’s business. Otherwise, it would be absurd to keep doing something the same way and miraculously hoping that the results will be different.

Reports

Finally, we will document the company’s ESG status by generating reports. They are ideal for showing the firm’s performance and progress. One can also use these reports as references later. They are also effective in showing the stakeholders the details easily.

Why Riverstone ESG Consulting

You have quite a number of reasons to consider us for ESG assessment services;

Vast Experience

First, we have been doing this for a considerable time and have mastered the art of ESG assessment over the years. Besides, our staff members have deep knowledge and hence are in a position to guide you accordingly. We have served many clients and hence understand everything concerning the service. Therefore, your organization will be safe if it trusts us to assist in handling this.

Impressive Track Record

Clients we have served before can say without any fear of contradiction that we are good at what we do. Neutral third parties can also attest to our experience in this field. As far as sustainability, especially matters concerning ESG, we are the go-to partners. We have accreditations from various international bodies, which also speak volumes regarding the level of our expertise in ESG assessment.

Wide Diversity

Regardless of the industry your organization falls under, Riverstone ESG Consulting has your back. The same applies to sectors that are intertwined, including all the ones that overlap. After all, we have worked with businesses across various industries. Consequently, we understand them well enough to help you navigate the world of ESG. That’s why you shouldn’t hesitate to consider us if you are looking for ESG policy development and strategy implementation services.

Skilled Personnel

We only hire the best employees to help our clients develop and implement the best ESG policies and strategies. After all, only a deep understanding of the subject can help handle environmental, social and governance issues. Thanks to our talent, customer support is at another level. Staff won’t take forever to address an issue. The response is also usually correct, accurate, and reliable.

Affordability

Even before we talk about affordability, we offer free consultation to our customers. Therefore, small, medium and large companies can benefit from our services. You don’t have to break the bank to afford what we offer. Lastly, we don’t compromise on the quality of services in the name of achieving affordability. On the contrary, we ensure you get the best value for your money.

Procedural Approach

For every service we offer, Riverstone ESG Consulting has a procedure to guide us in delivering the best approach. The approach ensures that we leave no stone unturned as we deliver the solution your business needs. It reduces the chances of any error as we develop or implement an ESG plan. You also get to know the process, including what’s done or pending, thanks to these procedures. Such transparency is crucial yet rare.